10

HIRE AND RENTAL NEWS • APRIL/MAY 2015

INDUSTRY NEWS

Overall, the American Rental Association

(ARA), through its ARA Rental Market

Monitor subscription service, forecasts

equipment rental industry total revenue

growth of 8.1% in 2015 to reach $38.5

billion in the US, including all three

segments – construction/industrial,

general tool, and party and event.

Construction/industrial rental revenue is

forecast to increase 8.5% in 2015 to

$26 billion, with general tool projected to

grow 8.3% to $9.9 billion and party and

event to show a 4.5% increase to

$2.7 billion.

“The equipment rental industry continues

to grow at a fast pace with strong

equipment rental demand within all

markets,” Christine Wehrman, ARA’s

executive vice president and CEO said.

“While the news focuses on the energy

sector of the economy, our industry is

fortunate to have a balanced marketplace

US equipment rental industry forecast to grow

A strengthened economy, growth in employment and lower gas prices at the pump,

generating increased disposable income, all spell favorable news for consumers as well as

the equipment rental industry in the United States.

in which rental is in demand and energy

represents only one of those markets.

Rental companies have always been

flexible in meeting customer demand by

adapting quickly to changing markets. The

industry growth forecast remains more

than double that of the overall economy.”

“The number of positive offsets in

commercial construction, multifamily

housing, healthcare and manufacturing

help to counteract the drop in oil prices

and contribute to the strong 2015 growth

projections for the equipment rental

industry,” Scott Hazelton, Managing

Partner, IHS Inc said. IHS is a global source

of information and insight and compiles

data for the ARA Rental Market Monitor.

Also, a decrease in oil prices does not

mean the energy sector growth stops.

“Natural gas and oil extraction growth

will likely be slower in 2015 and 2016, but

it is important to note extraction actually

increases, just at a slower rate, even with

lower oil prices,” Scott said.

Projected revenue increases for equipment

rental due to more direct and indirect

demand from the energy sector may be

lower now than previously expected, but

Scott said the other rising segments for the

equipment rental industry will remain a

positive factor for 2016 as well.

“IHS already had projected softness in the

energy markets in 2016, so the quick drop

in oil prices now presents less of a change

in the overall forecast for the equipment

rental industry,” Scott said.

The forecast for Canada calls for 3.7%

growth in 2015 to $4.1 billion, with growth

of 6.3% expected in 2016 to nearly

$4.4 billion.

“We continue to monitor our industry on

a quarterly basis to ensure our members

have the best information available,” Chris

Wehrman said. Visit:

www.ARArental.orgAccording to Plant Assessor,

if you are involved in the

supply of equipment to

the mining and extractive

industries in NSW, you will

have encountered MDG15.

MDGs contain

comprehensive guidance

on specific safety issues

and are increasingly used

outside NSW where the local

jurisdiction does not have

definitive guidelines in the

particular area covered by

the MDG, Plant Assesor said.

MDG 15 (Guideline for

Mobile and Transportable

Equipment for Use in

Mines) sets out the safety

requirements for the design,

manufacture and operation

of Mobile and Transportable

Equipment for Use in Mines.

MDG15 was first published

in 1992, and revised in 1994,

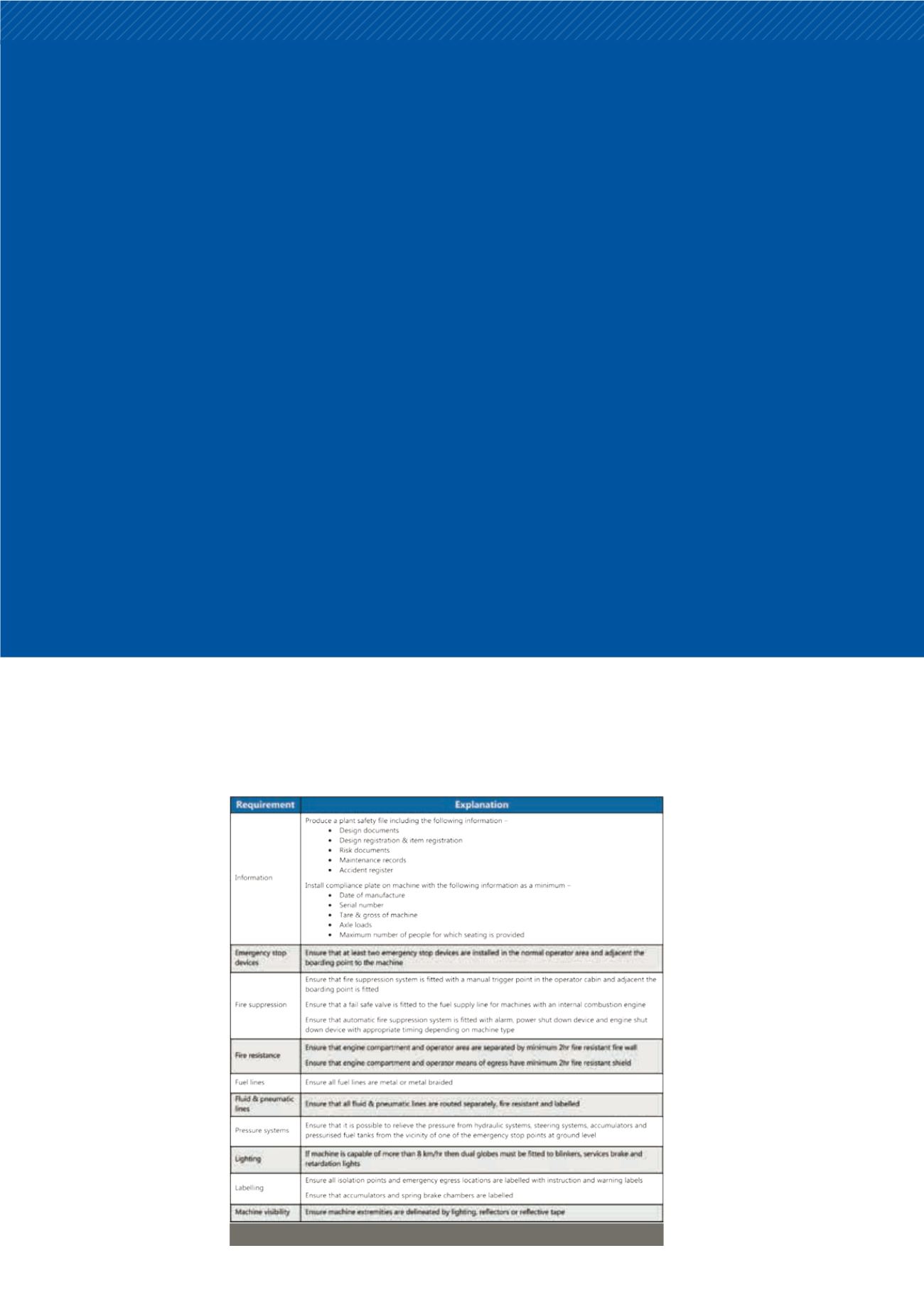

Plant Assessor MDG 15 Assessment for mining industries

Plant Assessor has developed a special assessment purpose which incorporates the specific

additional requirements of MDG15 (Mining Design Guideline, a term coined by the Mines

Safety Regulator in NSW) over and above a standard Plant Assessor assessment.

1997 and 2002. Because this is a

special assessment purpose and

contains considerable additional

inspection items, Plant Assessor

said it has chosen to make it an

opt-in assessment purpose to

avoid any confusion among users

that have no need for MDG15

assessments.

Some of the questions in a MDG15

assessment will require reference

to OEM manuals, removing of

guards and covers, and in some

instances confirming certain

matters with the machine’s

manufacturer to ensure the

requirements are met.

The table developed by Plant

Assessor provides an overview

of the more detailed application

of existing PA requirements

and mine department specific

requirements.

Contact: 1300 728 852 or visit:

www.assessor.com.auMDGs contain comprehensive guidance on specific safety issues